The first month of the National Bank of Malawi’s (NBM) Mo Cardless Withdrawal Promotion has seen customers generating 15, 785 tokens which are used to access money without ATM Cards.

NBM launched the promotion last month with the grand prize pegged at K1.5 million for the first winner, while the second and third lucky ones will cart home K1 million and K750,000.

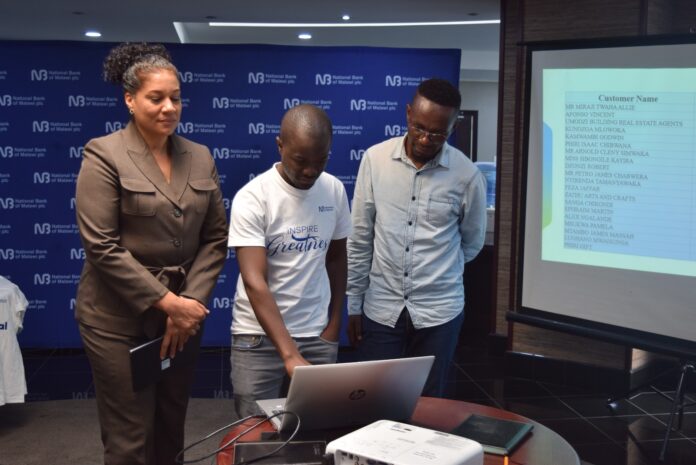

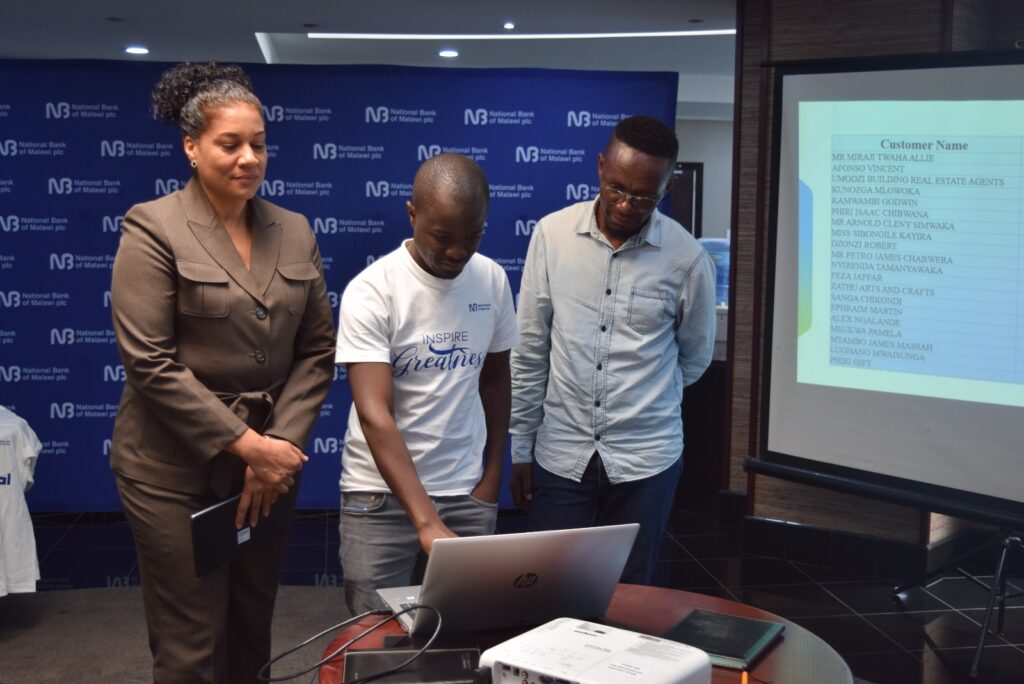

Speaking when they conducted the first draw in Blantyre on Friday, the Bank’s Mobile and e-Money Services Manager, Enala Chirwa said the figure represents the overwhelming response from customers in embracing the digital services.

“We want to ease access for the customers’ money even when they do not have cards with them. Our digital financial services strive to see customers getting away with the hassle of being on the queue to access their money when they can do so at the comfort of their homes. Through our cardless service, our customers can generate the token from their phones and access the money,” said Chirwa.

During the first monthly draw, 50 customers won various prizes including cash for generating the tokens and redeeming the money through the Bank’s Autoteller Machines (ATMs).

Out of the 50 drawn, 20 won K30,000 cash prizes each, while 15 customers won NBM branded T-shirts and the other 15 won NBM branded magic cups.

Customers with the highest tokens generated and redeemed at the end of the promotion, will go away with the grand cash prize.

According to NBM, in cases where more customers generated the same number of tokens and redeemed, the winner will be identified based on the value of cash redeemed, as the one with the highest value will be considered the winner.